Insurance customers cover carriers’ financial losses through higher premiums and rates. That being said, insurance fraud probably has a stronger financial impact on policyholders than on insurers. So a strong fraud prevention system is essential for companies willing to not only protect themselves from fraudulent actions but also to offer lower rates and a more delightful experience to customers.

Insurance fraud detection is a set of practices implemented by insurers to identify and prevent fraud from policyholders or third parties.

Not so long ago, insurers were primarily relying on claims adjusters’ experience in fraud detection efforts. Later, rule-based systems appeared, allowing organizations to automate the identification of potentially fraudulent claims. Today, these traditional security methods don’t cope with sophisticated fraud. Businesses need to explore advanced big data solutions to have a competitive advantage in the fraud detection ecosystem.

In further sections, we’ll introduce you to the biggest trend in insurance fraud detection, which is predictive analytics, and suggest software you need to add to your toolkit to support your fraud prevention activities. Meanwhile, let’s talk about the state of insurance fraud detection these days.

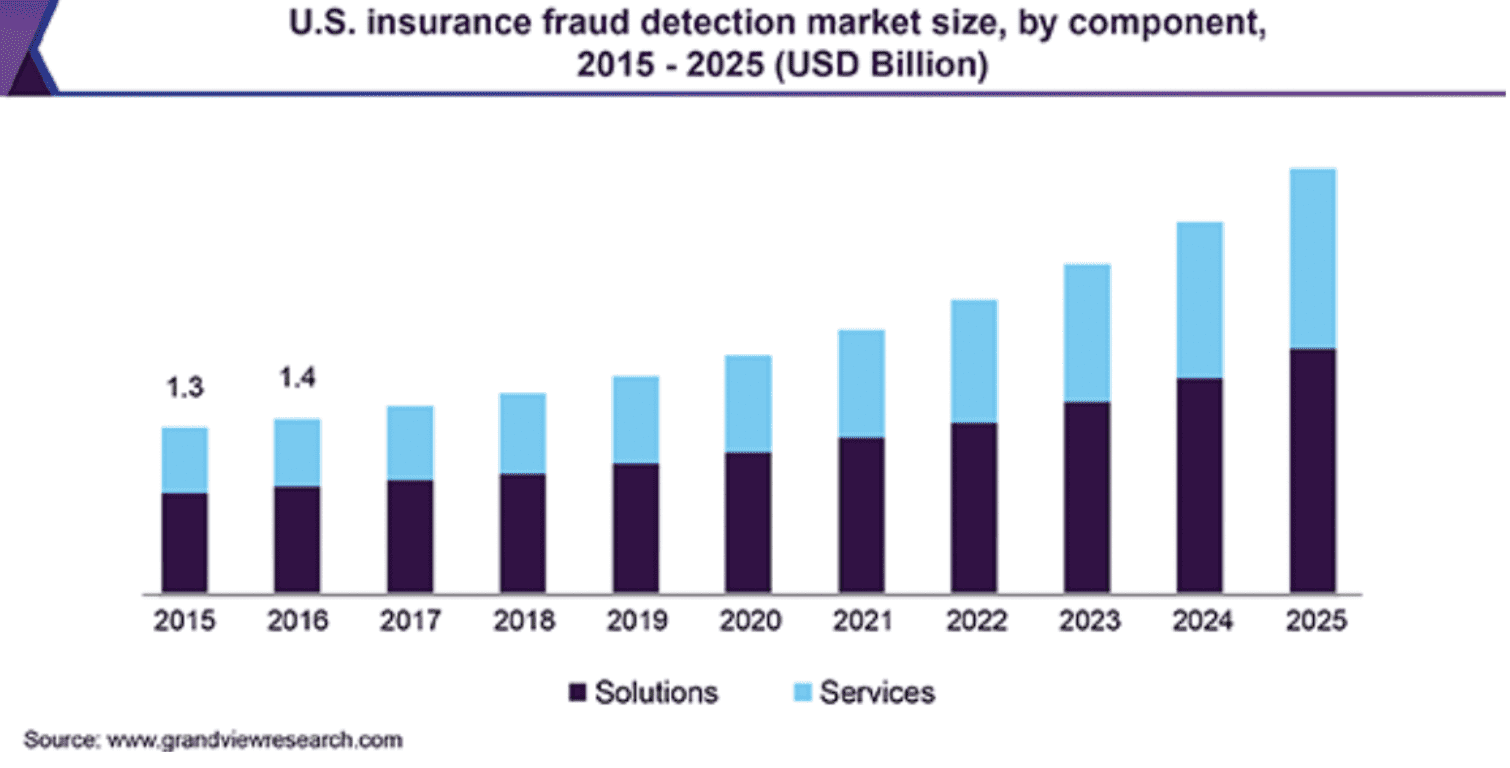

As digitalization is increasing insurance fraud risk, the insurance fraud detection market is also growing rapidly. It’s expected to grow at a compound annual growth rate of 13.7% from 2019 to 2025 and may reach $9.7 billion by 2025.

In light of evolving fraud detection technologies, insurers have already reached some remarkable milestones in proactive attempts to mitigate and reduce losses caused by fraud. With the adoption of technologies such as big data, AI, machine learning, and the Internet of Things (IoT), insurance companies are able to significantly improve their detection capabilities.

According to ABI’s latest detected general insurance fraud figures , fraud detection rates are steadily increasing year after year. For instance, while the total number of motor insurance claims has decreased since the pandemic outbreak, auto fraud detection rates increased by 0.55% to 2.05%.

Apparently, with the newest fraud detection technologies, insurers can do a better job of protecting not only their budgets but also their customers.

100% of insurers surveyed by Friss have mechanisms helping them to identify potentially fraudulent claims. However, the report shows that only 62% have implemented fraud detection technology solutions, with as few as 42% relying on predictive models and AI.

Yet the SaS State Of Insurance Technology Study reveals very different statistics. According to the study results, as many as 88% of surveyed insurers have automated fraud detection, with 80% of insurers having already incorporated predictive modeling in their strategies.

Nevertheless, the full capabilities of predictive analytics are yet to be explored by carriers. But it’s already prominent that the method is shaping the future of the insurance industry. Here’s how.

Predictive analytics is the use of historical data, machine learning algorithms, and statistical modeling to foresee future events.

Predictive analytics in insurance fraud detection is the use of data and statistical techniques to automatically identify fraud patterns and reveal potentially fraudulent claims.

To make use of predictive analytics, insurers need to apply advanced AI-powered technologies. Predictive analytics tools collect data from different sources, including customer portals, self-service apps, customer relationship management (CRM) systems, telematics, smart homes, etc. and process it to deliver accurate predictive insights.

Fraud detection is only one use case of predictive modeling in insurance. It’s also widely used in the processes like insurance pricing, underwriting, risk assessment, claims management, etc.

Proactive insurance fraud detection powered by big data carries a lot of benefits for insurers and their customers. Below are the most significant ones.

AI technology not only automates the fraud detection process but also identifies fraud patterns allowing early flagging and prompt response to any potential incidents.

As the number of clients increases, claims adjusters are put under higher pressure and should either sacrifice the accuracy or the speed of the claims process. On the contrary, the more data machine learning algorithms receive, the faster they provide accurate results.

Next, predictive analytics delivers way more accurate results than a human agent can do. As a result of processing big data, digital tools have more information to make decisions with never before seen accuracy.

A purely reactive approach (response) is a thing of the past. Big data brings in more opportunities to conduct proactive fraud detection initiatives.

The technology identified the root causes of fraudulent activities and uses the data to foresee fraud and combat it proactively.

By maximizing the use of technology and data analytics, insurers reduce the number of manual interventions in the claims management process. This reduces turnaround times and frees up insurance agents allowing them to focus on more valuable, high-impact tasks.

With more accurate fraud detection and reduced false positives made possible by AI technologies, insurers can decrease financial loss significantly. Also, by automating repetitive processes like fraud detection, you won’t need to increase your headcount as you scale up – which otherwise would have come with extra costs.

All things considered, automated insurance fraud detection powered by AI and big data allows insurers to reduce costs and offer more competitive insurance plans to customers.

To combat insurance fraud effectively, you can’t solely rely on your experience and traditional methods. You need the right technology. We offer you to choose one of the three tools below.

FRISS Fraud Detection is a part of the FRISS ultimate toolkit for fraud, risk, and compliance for insurers.

The FRISS Hybrid Detection Model combines AI, instant-on standardized fraud

indicators, analytical and predictive models, external data sources, and more technologies to screen each claim and identify signs of potentially fraudulent activities. The solution can be seamlessly integrated with any core insurance system with minimal effort from the IT department.

What’s most important, this AI-powered fraud detection software detects suspicious claims in real-time enabling insurers to catch fraud before claims are paid.

Similar to FRISS, the platform focuses on detecting, preventing, and managing claims fraud specifically for insurance companies.

SAS Detection and Investigation for Insurance identifies suspicious activities, uncovers hidden relationships, and detects fraud patterns by using multiple techniques such as automated business rules, AI and machine learning methods, text mining, anomaly detection, etc. The software is capable of scoring millions of claims records in real-time or in batch automatically.

The key features of the platform include:

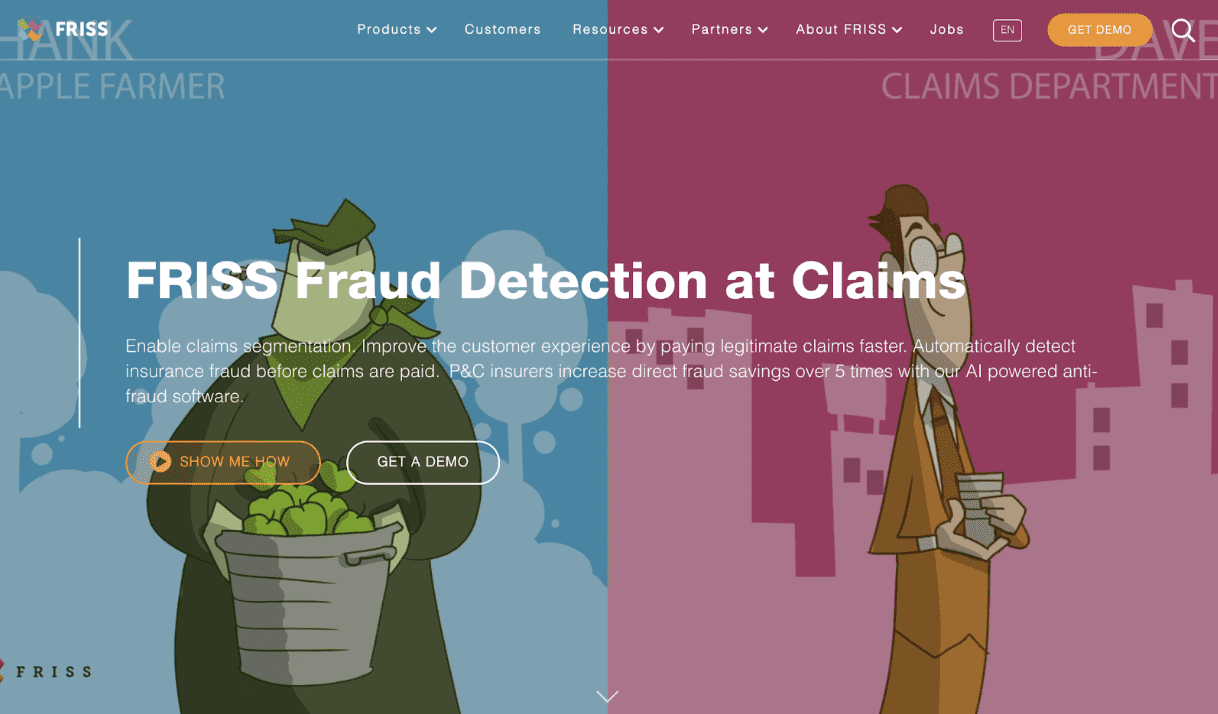

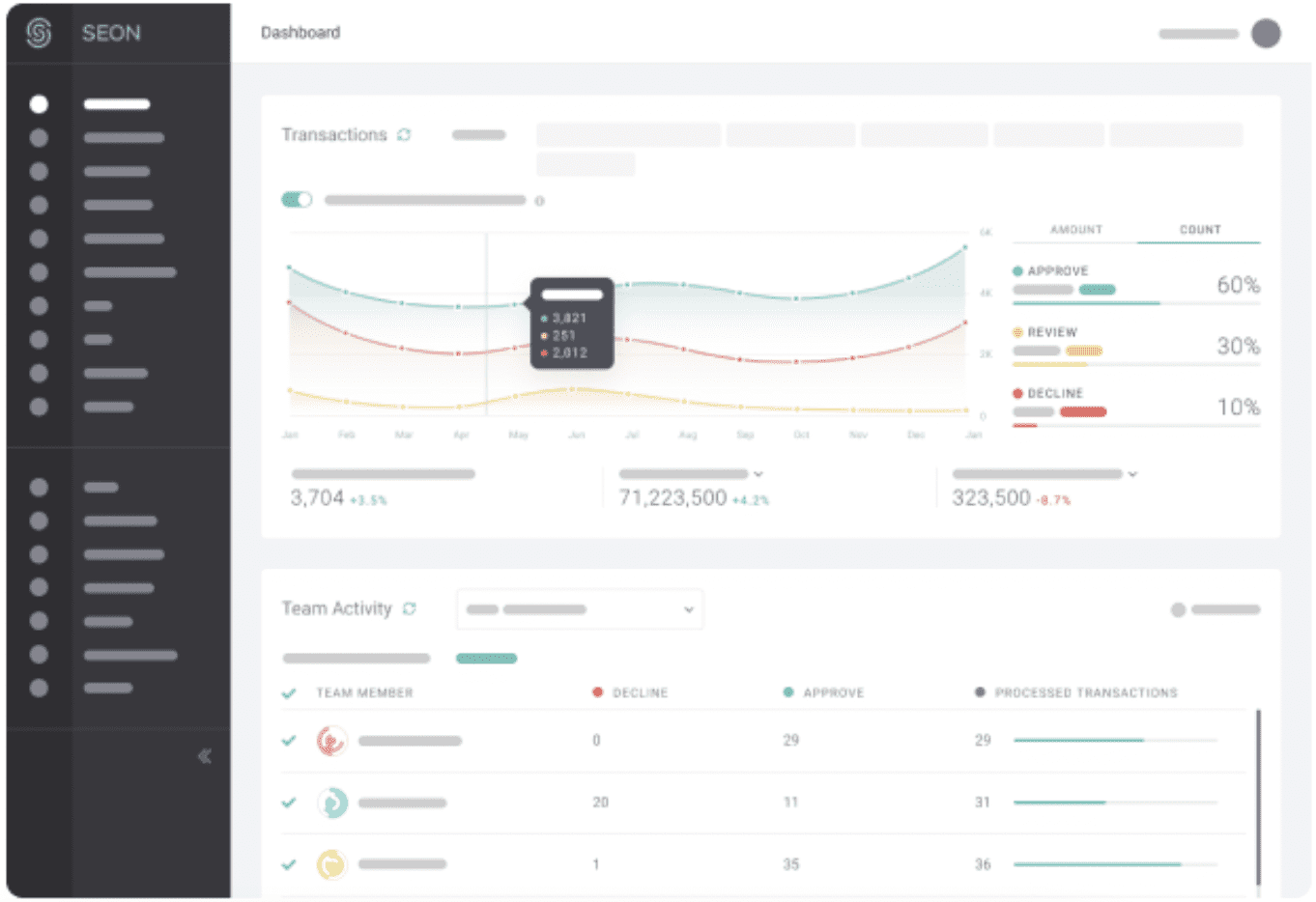

SEON is an anti-fraud system for online businesses. It’s not tied specifically to the insurance industry, but it offers all the necessary tools to empower insurers to promptly detect fraud threats. If you offer digital insurance services, you should definitely consider adding SEON to your toolkit.

The platform automatically handles the following tasks:

SEON uses machine learning algorithms to quickly learn fraud patterns and improve the accuracy of fraud investigations.

Insurance fraud detection is a set of practices implemented by insurers to identify and prevent fraud from policyholders or third parties.

Predictive analytics is the use of historical data, machine learning algorithms, and statistical modeling to foresee future events.

Drive adoption of your digital claims and insurance applications with WhatfixDigital insurance applications power providers to detect fraudulent claims – but only if their agents properly utilize their claims technology. With Whatfix, providers can create in-app guidance for their new digital insurance applications that helps provide contextual learning, reinforcement training, and on-demand support for their agents and employees.